After years of tightening regulations, a significant shift is beginning to take shape. Although regulatory pressures are easing, significant challenges still remain. Companies must now identify what truly matters, set clear priorities and direct their resources effectively to address the challenges regarding digitalization and sustainable transformation initiatives. In this new landscape, relevance must be earned. Strategic clarity isn’t optional – it’s essential for resilience and long-term success, as it fosters responsible decision-making and maximizes positive impact.

Einstieg | Lead & Editorial | Issue No. 27

Einstieg | Inserenten | Issue No. 27

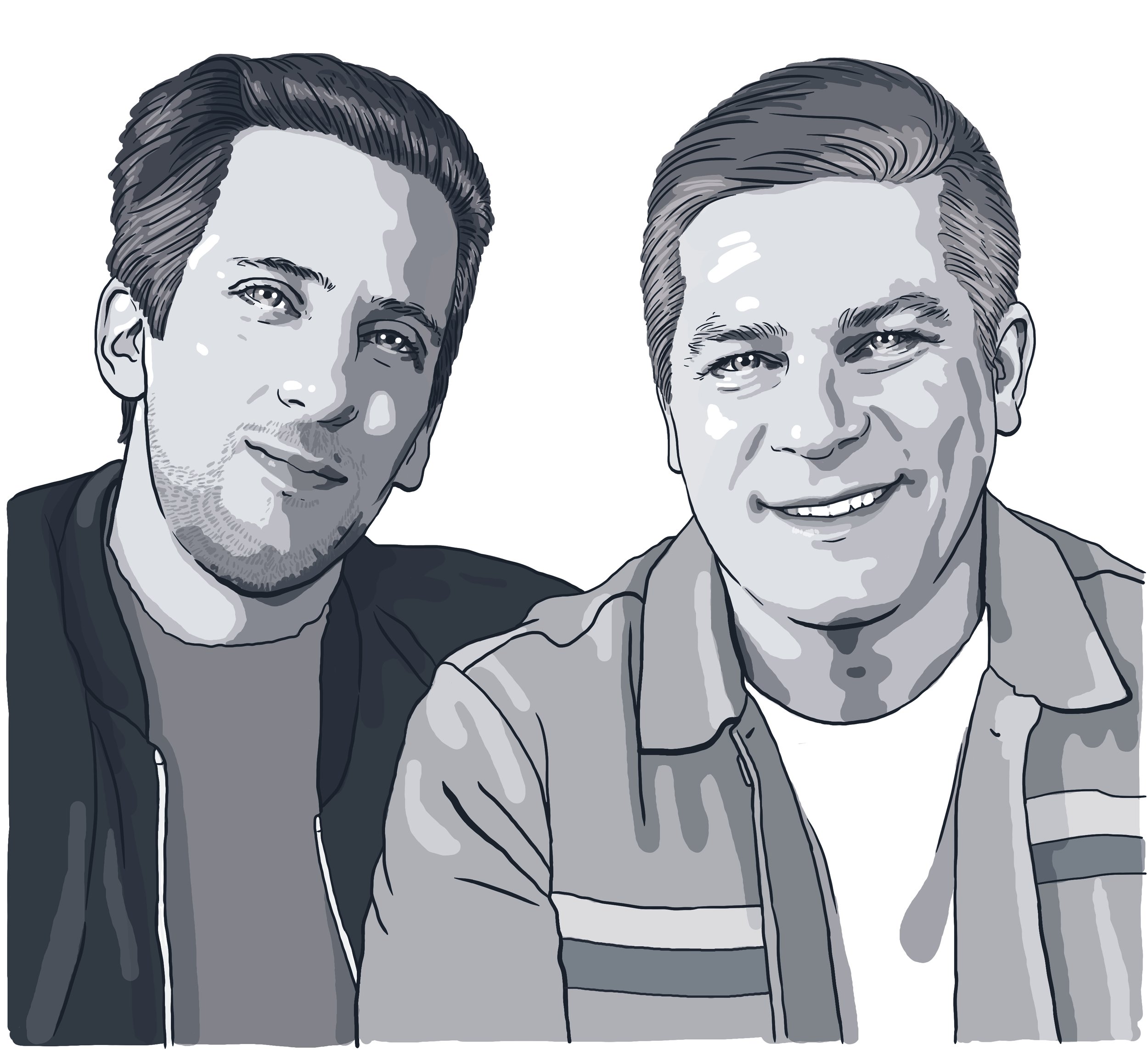

Interview | «Die Post muss ein starkes Unternehmen bleiben.»

Alex Glanzmann im Gespräch mit Walter Thomas Lutz und Reto Schneider

Seit Frühling 2025 leitet Alex Glanzmann interimistisch die Schweizerische Post. Im Interview mit The Reporting Times spricht er unter anderem darüber, wie die Post einen starken Service public weiterentwickeln will und welche Herausforderungen er für seine Kernaufgabe als CFO erwartet.

CCR Marketplace

By Center for Corporate Reporting

We are dedicated to providing our members with relevant and up-to-date information on internal and external reporting, as well as digitalization, and firmly believe in the power of peer-to-peer learning and exchange to foster genuine learning. Our ongoing exchange series provides a strategic advantage by supporting growth and resilience amid evolving uncertainties, such as regulatory changes or technological innovation.

Natur-Reporting bei der Rhätischen Bahn

Von Simeon Eichelmann

Viele sehen Naturverlust als Teil der gesellschaftlichen Verantwortung von Unternehmen. Zunehmend wird es jedoch zu einem finanziellen Risiko. Wenn Wälder verschwinden oder Flüsse verschmutzt werden, kostet das viel Geld. Besonders betroffen sind Sektoren wie Landwirtschaft, Energie, Transport, Bau und Tourismus. In diesen Bereichen ist klar: Ohne gesunde Natur ist wirtschaftlicher Erfolg in Gefahr. Hier hilft die Taskforce on Naturerelated Financial Disclosures (TNFD). Sie schafft ein Rahmenwerk, um naturbezogene Risiken und Chancen zu bewerten und offenzulegen.

Putting People at the Heart of Business Strategy and Reporting

How the U.S. is rebalancing shareholder activism

By Timothy M. Doyle and Robert G. Eccles

The U.S. Securities and Exchange Commission (SEC) recently issued Staff Legal Bulletin No. 14M (SLB 14M), the latest turn in a decades-long debate over how to balance shareholder input with managerial discretion. Though technical in format, SLB 14M cuts to the heart of a larger transatlantic discussion. What role should corporations play in society, and how should shareholder activism influence that role?

«CCO Compass 2025»: Kommunikation in der Zeitenwende

Die Kunst des Überzeugens – Rhetorik ist Führung

Von Viktor Baumgartner

In einer Welt, die sich im lautstarken Dauerwandel befindet, steigt die Zahl der Worte – und sinkt zugleich deren Wirkung. Das hat einen Grund: Menschen hören nicht mehr wirklich zu. Aufmerksamkeit ist ein seltenes Gut geworden. Sie zu erlangen, bedingt präzise Kommunikation. Wer sie weckt, erzielt Wirkung. Wer sie hält, gestaltet. Wer sie bekommt, führt. Wer sie verspielt, verschwindet im Grundrauschen. Voraussetzung dafür ist, Sprache als Führungsinstrument zu verstehen und wenige, aber hilfreiche Methoden zu verinnerlichen.

Corporate Communications in an age of unravelling

By Chris Hogg

In an era marked by disinformation, digital disruption and global instability, how should corporate communicators navigate the “age of unravelling”? This opinion piece offers insights on maintaining clarity, consistency and connection amid volatility, and outlines principles for delivering stability and trust as a counterpoint to the instability and disruption in a post-truth world.

Warum gelebte Werte zur Schlüsselressource der Unternehmenskommunikation werden.

Von Valentin Heisters und Olaf Leu

Die Kommunikation der eigenen Marke wird zunehmend schwieriger zu steuern. Menschen erkennen heute schneller die Haltungen, die hinter Aussagen und Handlungen stehen – sie unterscheiden zwischen Substanz und blossem Marketing. Dennoch bleibt es essenziell, die Kommunikation mit den unterschiedlichen Anspruchsgruppen plan- und steuerbar zu gestalten.

Relevant sind wir!

Von David Bach

Kürzlich gestand mir ein CEO eines grossen Unternehmens, wie geradezu einfach das Führen vor fünf Jahren schien: kein Krieg, keine Pandemie, eine stabile internationale Ordnung. Seit 2020 hat sich alles verschoben: Die Coronapandemie riss uns aus unserem gewohnten Trott und liess uns flexibler werden; der Krieg in der Ukraine machte uns die Fragilität einer heilen Welt bewusst und lehrte uns, die richtige Seite zu wählen; und der disruptive Führungsstil an der Spitze der Weltmacht USA zwingt uns nun, uns und unsere Organisation zu überprüfen und neu aufzustellen.

Interview | Der CFO als Navigator – nicht nur im Finanzbereich

Anna Kremer im Gespräch mit Tobias Naumann

SAP ist ein international operierender deutscher Softwarekonzern und das wertvollste börsennotierte Unternehmen im DAX und in Europa. Die Kunden der SAP erzeugen 84% des weltweiten Handelsvolumens, wobei 98 der 100 grössten Unternehmen der Welt SAP nutzen. Mit mehr als 109.000 Beschäftigen in über 157 Ländern steht das Unternehmen im Zentrum der digitalen Transformation. SAP Deutschland CFO Tobias Naumann sieht in der digitalen Finanztransformation die Chance für Unternehmen, Prozesse zu optimieren, Kosten zu senken und durch innovative Technologien Wettbewerbsvorteile zu erlangen.

Focus - Simplification - Dialogue | Geschäftsberichte-Symposium 2025

7 Antworten von

Focus on business relevance

By Julia Wittenburg

For anyone who has followed the ESG movement in finance, and specifically in investment management in the last twenty years, the current headwinds stemming from ESG critics represent a temporary and perhaps even necessary correction in a long-term journey. It brings non-financial risk and opportunity management closer to an integrated approach in mainstream investing. In fact, this temporary re-assessment indicates that, far from being abandoned, the topic has reached a level of maturity that calls for more rigorous definitions, more sector-specific refined practices and a move towards aligning sustainability goals with core business values that primarily focus on financial materiality.

Reputation Management in the Age of AI – Rethinking Corporate Rankings

By Steffen Rufenach and Shahar Silbershatz

In a digital world defined by growing complexity and shrinking attention spans, simple stories capture attention. That’s why corporate rankings are increasingly critical to reputation management. As generative AI tools such as ChatGPT replace the traditional internet search, they fundamentally change how people access information. This article outlines why rankings management is now essential to every company’s reputation strategy and presents a four-step approach to boost visibility in AI-generated results.

Sprachkolumne | Alles drin. Nur keine Leser:innen.

Von Fabian Dieziger

Hundert Seiten, vier Sprachversionen, monatelange Abstimmungen – und trotzdem ernüchternde Zugriffszahlen. Geschäftsberichte werden produziert wie Prestigeprojekte. Gelesen werden sie, wenn überhaupt, nur im Schnelldurchlauf oder von Maschinen. Zeit für die unbequeme Frage: Für wen schreiben wir das alles eigentlich?

Good Corporate Governance: mit Substanz zur Relevanz

Von Antoinette Hunziker-Ebneter

Geschäftsrelevanz ungeachtet der konjunkturellen und politischen Grosswetterlage aufrechterhalten zu können, ist kein Zufall. Diese Fähigkeit ist vielmehr Ergebnis und Ausdruck einer fest verankerten Wertekultur, des Vermittelns des unternehmerischen Selbstverständnisses jenseits des Profits und einer guten Corporate Governance.

Merck’s approach to CSRD reporting: the Sustainability Data Initiative

By Kai Zinn

In recent years, the landscape of sustainability reporting has undergone significant transformation, driven by increasing regulatory requirements and stakeholder expectations. With the introduction of the EU Corporate Sustainability Reporting Directive (CSRD), organizations are now faced with the need to significantly enhance their reporting and data collection processes.

AI Governance: from compliance burden to strategic business advantage

By Elena Maran and Kevin Schawinski

As AI adoption accelerates, organizations face a critical challenge: harnessing AI’s transformative power while managing its unique risks and regulatory complexities. Too often, AI governance is seen as a compliance burden that limits innovation. This misses a crucial insight: properly implemented governance enables organizations to move faster, innovate confidently and build a sustainable competitive advantage.

Sustainability in innovation: time to walk the talk

By Mars Aeschlimann and Samantha Oberholzer

In today’s complex business environment, sustainability has become more than a KPI or marketing initiative – it’s an innovation imperative. As stakeholders demand more than incremental change, companies and teams are challenged to rethink not only what they innovate, but how. What does it look like when sustainability becomes a conscious part of the innovation process? And what does it take to truly align action with ambition in a responsible way?

Die neue Wesentlichkeitskonzeption zur Taxonomie-Verordnung

Von Prof. Dr. Christian Fink und Prof. Dr. Dr. Alexander Moutchnik

Die Taxonomie-Verordnung verfolgt das Ziel, Kapitalströme und Investitionen gezielt in ökologisch nachhaltige Aktivitäten und Projekte umzulenken. Voraussetzung dafür ist ein klar definiertes und einheitliches Verständnis darüber, welche Unternehmensaktivitäten tatsächlich als ökologisch nachhaltig gelten. Dazu stellt die Taxonomie- Verordnung ein kriterienbasiertes System bereit, das eine präzise Klassifizierung ökologisch nachhaltiger Wirtschaftsaktivitäten ermöglichen soll.

Beyond Regulation: how continued sustainability disclosure by SMEs builds investor trust

By Dr Rupini Deepa Sobottka

As investor demand for environmental, social and governance (ESG) data grows, small and medium-sized enterprises (SMEs) have a unique opportunity to build trust and attract capital through voluntary, meaningful sustainability reporting. Despite existing challenges and the easing of European Union (EU) regulatory sustainability reporting demands, regularly reporting on key areas such as emissions, workforce diversity and governance can help SMEs strengthen their growth prospects and appeal to long-term investors. This article explores how sustainability reporting, if done right, can be a strategic asset, not a burden.

Wie Sie Klimarisiken investorenfit kommunizieren

Von Tanja Nagel und Prof. Dr. Ralf Frank

Banken und Investoren schauen genauer hin, denn mit verschärften Anforderungen von Regulatoren und Marktaufsicht wächst der Druck auf Kreditinstitute und Assetmanager, Klimarisiken zu berücksichtigen. Unternehmen müssen sich auf steigende Anforderungen von Kapitalgebern einstellen. Heidelberg Materials zeigt, wie systematisches und transparentes ESG-Reporting zum Wettbewerbsvorteil werden kann.

Auf ein Wort mit...

Beilage Deutschland | ESRS Light – Nachhaltigkeitsberichterstattung mit Weitblick

Komplette Ausgabe | Issue No. 26 | FOCUS–SIMPLIFICATION– DIALOGUE

Despite the increased uncertainty surrounding the implementation of regulations, the necessity for transformation towards resilient and sustainable business models persists. The volume of data is rapidly increasing, along with the challenge of communicating strategy clearly and concisely. Companies are revising their corporate governance, establishing new auditable processes, and experimenting with AI to boost efficiency. To navigate this transformation process, engaging in dialogue with internal and external stakeholders is crucial.

Einstieg | Lead & Editorial | Issue No. 26

Einstieg | Inserenten | Issue No. 26

Interview | «Nachhaltigkeit ist für mich eine Lebensaufgabe»

Von Walter Thomas Lutz mit Jörg Eigendorf

Die Deutsche Bank ist die führende Bank in Deutschland mit starken europäischen Wurzeln und einem globalen Netzwerk. Dabei versteht sie es als ihre Verantwortung, Teil der Transformation zu einer nachhaltigen Gesellschaft und Wirtschaft zu sein und will mit ihrer finanziellen Expertise und ihrem Produktangebot den Weg zu einer nachhaltigeren Wirtschaftsweise ermöglichen.

From Vision to Reality: Clariant implements AI in integrated reporting

By Yvonne Schneider and Kai Rolker

For an extended period, the utilization of artificial intelligence (AI) for the preparation of integrated reports was considered a visionary concept. However, the specialty chemicals company Clariant is now leading the way with an innovative approach. The AI assistant “Clarita” aims to enhance the quality of the integrated report while freeing up resources for other critical tasks.

Fokus auf Impact: Klimaziele der AMAG nach SBTi

Von Ina Walthert und Stephan Lienin

Ein SBTi-Ziel gibt Entscheidungsträgern Sicherheit und klare Leitlinien für die Umsetzung eines wirkungsvollen Klimaschutzes. In der AMAG Gruppe unterstützt es die unternehmerische Transformation mit dem strategischen Ziel, dekarbonisierte Mobilitätslösungen zu entwickeln.

Die McNamara-Fallacy – Der glaube an die (falschen) Daten

Green Claims: a practical guide how to avoid Greenwashing

By Adrian Peyer

Environmental claims in marketing and product communication are under increasing regulatory and consumer scrutiny in both the EU and Switzerland. The EU Consumer Empowering Directive and the Green Claims Directive introduce stringent requirements for companies making environmental claims, ensuring transparency and preventing greenwashing. In Switzerland, the new Article 3 lit. x of the Unfair Competition Act (UCA) explicitly prohibits unsubstantiated climate-related statements.

Sustainability disclosures – definitely no longer a “nice to have”

By Christian Leitz

In the 2020s, sustainability disclosures have become a key focus of regulators globally as they intend to create better comparable data and information on the sustainability performance of companies. This will help the assessments by investors and other stakeholders, though the continued divergence of regulations will remain a hindrance to full comparability.

Ending the alphabet soup of sustainability disclosure: how the ISSB creates the global baseline

By Jenny Bofinger-Schuster

In November 2021, when the establishment of the International Sustainability Standards Board (ISSB) was announced, I instantly felt it was the right initiative, at the right time, within the right home – the IFRS Foundation. Although I hadn’t foreseen playing a personal role, I luckily became deeply involved. After two years as a Board member, I remain convinced that our work is both right and relevant.

From Vague to Value: Mastering CSRD’s DMA with Impact Valuation

By Sonja Haut

Hopes were high for the EU Green Deal and the intention to demand more sustainability-related business information. The promise of more transparency was to benefit both the preparer as well as the users of the disclosed information. The benefit for the preparer? Know before others do. For the users: comparability of businesses’ sustainability performance without having to invest time in personal interactions or to rely on untransparent ratings. Sustainability experts were certain this would set off a race to the top of sustainability performance.

Die Erfolgsreise der MDD in 25 Jahren Digitalisierung | Interview zum Jubiläum

Von Anna Kremer mit Armin Galliker und Fabio Negro

Seit mehr als 20 Jahren sind wir mit Leidenschaft dabei, den Berichterstattungsprozess einfacher und sicherer zu gestalten. Weil wir wissen, dass hinter jedem Bericht Menschen mit Geschichten und Zielen stehen, setzen wir auf partnerschaftliche Zusammenarbeit: Wir hören zu, denken mit und finden gemeinsam die beste Lösung – von der Datenerfassung bis zur Veröffentlichung als iXBRL-, PDF – oder interaktiven Onlinebericht. Denn am Ende geht es um mehr als Daten: Es geht um Vertrauen und Erfolg.