by Irene Perrin, Senior Consultant, Center for Corporate Reporting (CCR)

With the current wave of regulatory requirements around ESG reporting and the standardization of frameworks and requirements, sustainability reporting is running the risk of being reduced to a compliance exercise. Shifting the perspective to opportunities emanating from ESG regulation can open up business potential and lead to innovation, as the CCR Roundtable demonstrated.

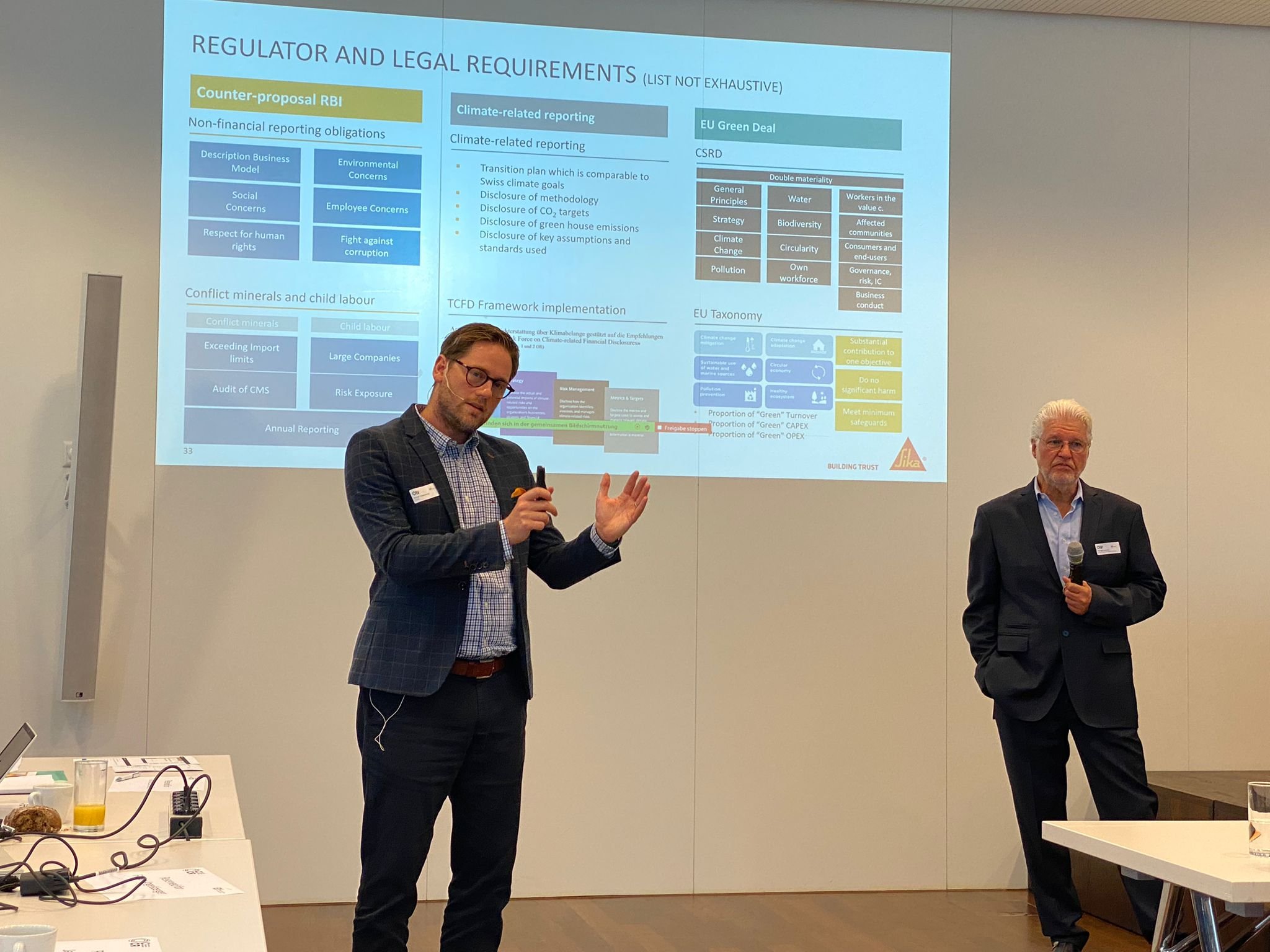

At the CCR Roundtable on October 27, 2022, about 35 participants listened to the presentations by Dr. Mark Veser, Head Climate Change and Sustainability Services at EY, who provided an update on the regulatory landscape; by Florian Angelsberger, Corporate Controller at Sika, who shared insights into what opportunities ESG brings to Sika, and by Jens Reissmann, Project Lead EU Taxonomy Reporting at Bayer, who shed light on how Bayer approached the EU Taxonomy implementation.

The presentations were then followed by a deep-dive discussion, moderated by the CCR, fostering exchange of experiences and perspectives.

The discussion made clear that uncertainty for reporting companies is currently very high, as the ESG reporting regulatory landscape is characterized by complexity, volume, partial misalignment between regulations and frameworks, shifting timelines, moving agendas, vague concepts and conflicting interpretations. Many companies struggle, but this is no excuse to get started.

The company examples showed that a systematic approach to topics such as climate change and net-zero pledges, to frameworks such as TCFD, and to regulations such as the EU Taxonomy also have benefits, such as bridging silos, building up new skills, stimulating innovation, or catalyzing change.

The goal to bring non-financials on par with financials will ensure that environmental and social factors are considered together with economic factors in decision making. The discussion showed that to reach this, a mindset shift is needed. The pressure from regulation pushes this mindset shift, as functions such as finance, marketing and innovation increasingly need to work together with sustainability. This bears the potential to make ESG data more robust, relevant and strategic.

A key challenge is data availability, quality and accessibility. Often, data relevant for ESG reporting is available within a company, but not connected. Connecting the data is a key challenge, but crucial to advance reporting.

The roundtable closed off in a networking lunch with personal conversations among participants.

CCR members can access the slides and key take-aways in the member section on our website. Individual support in the process of dealing with purpose and other matters around reporting be it as sparring partner for a second opinion or for an in-depth analysis of a related project is also part of CCR’s offering for its community. Contact us via the CCR Helpdesk.