CSRD-reporting – a value-add for investors?!

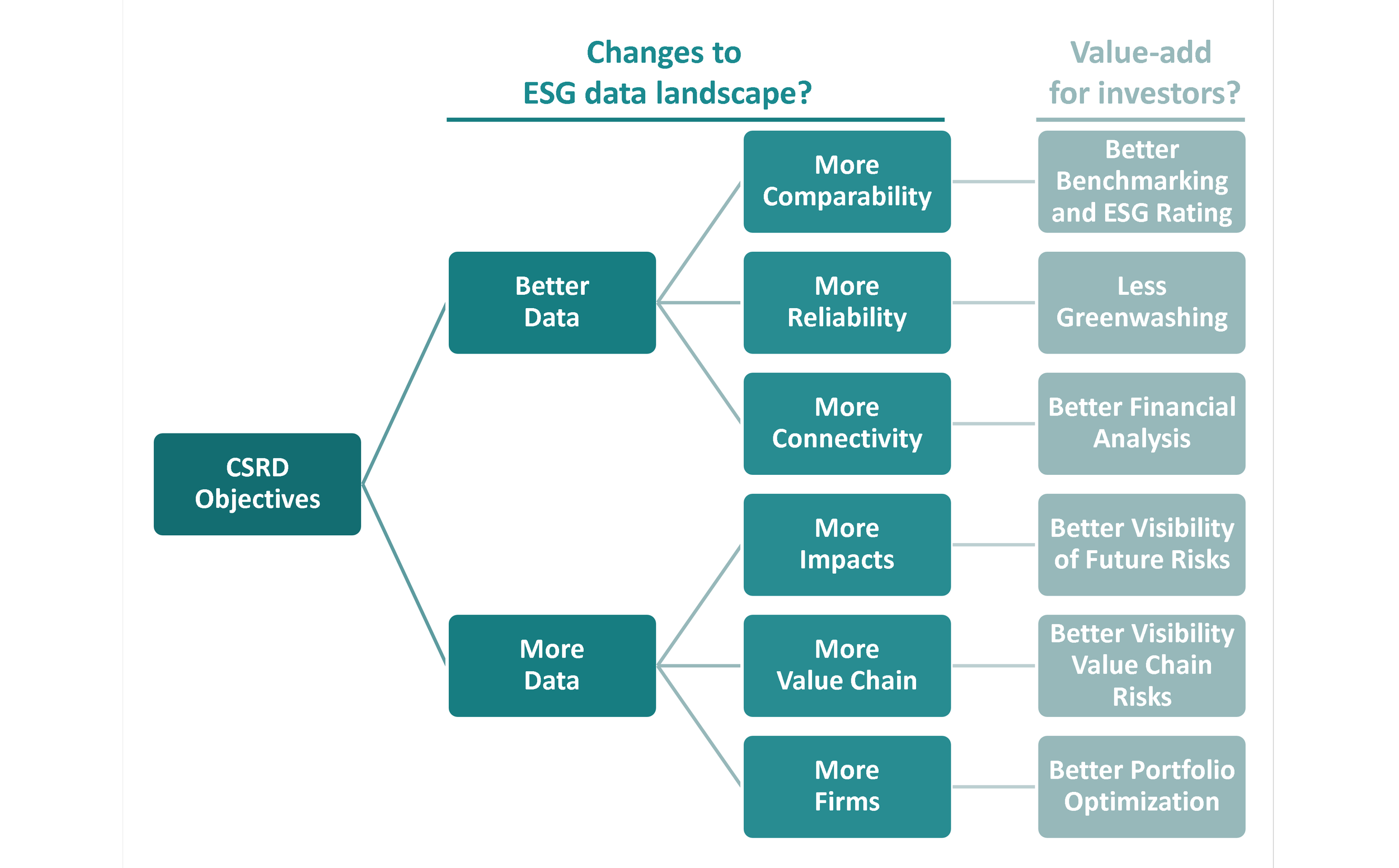

The CSRD set out to fundamentally improve the ESG information environment by enhancing both the quality and quantity of ESG data. From an investor’s perspective, better-quality data, through greater comparability, reliability, and integration with financial reporting, promises improved ESG benchmarking, sharper financial analysis, and more accurate risk assessment, while curbing greenwashing. At the same time, broader data coverage across companies, value chains, and externalities can enhance visibility into long-term risks and support more informed portfolio decisions.

By Maximilian Müller

CSRD objectives from the perspective of investors

However, whether these benefits materialize for investors depends on three critical factors. First, the discretion allowed in the double materiality assessment (DMA) may dilute comparability and limit disclosure scope. Second, it remains uncertain whether the standard-setter selected the KPIs and datapoints most relevant to investor needs, raising the question of whether supply meets demand. Third, the value of CSRD disclosures hinges on credible implementation. Weak enforcement or limited assurance could undermine data reliability and investor trust.

CSRD effects from the perspective of investors

Building on this ambition, our analysis of first-time adopters in the EURO STOXX 50 reveals several notable effects. Overall, sustainability reporting grew in volume by an average of 22 percent in word count, but this expansion was uneven. Some firms doubled their disclosures, others reduced them. Diverging DMA approaches, particularly top-down vs. bottom-up and gross vs. net IRO assessments, likely account for much of this heterogeneity because these choices directly affect the scope and granularity of information investors receive.

Importantly, the style and structure of reporting have become more aligned with financial disclosures. Reports now feature more tables and quantitative content, less imagery, and more standardized and complex language. Sentiment has shifted too, with an increase in negative wording, likely reflecting a stronger focus on impacts and risks. These trends signal a maturing ESG reporting landscape. On the positive side, most firms follow a common structure, include value chain information (albeit often with limited primary data), and many provide prior-year comparatives, which enhances interpretability. A high number of emission restatements also suggest improving data quality. However, few firms disclose anticipated financial effects of ESG issues like climate change, and reasonable assurance remains rare. This limits connectivity to financial decision-making and reduces the CSRD’s value proposition for investors.

Evidence from our Sustainability Reporting Navigator platform confirms that CSRD reports are attracting significant attention. Based on thousands of real-world queries submitted via our AI-powered assistant, which enables users to search directly within CSRD reports, stakeholders, including investors, most frequently seek information on emissions, workforce data, governance, and materiality assessments. Many of these queries focus on quantitative data, highlighting strong demand for standardized, comparable metrics. This direct insight into user behavior reinforces the relevance of the CSRD’s focus areas and the importance of high-quality, accessible ESG data. Firms themselves can also benefit from adopting more digital, interactive formats, such as web-based reporting or integrated search tools. These make ESG data easier to navigate and allow companies to learn from user traffic. Some early movers have already embedded AI assistants into their ESG disclosures (e.g., Asana), helping to better serve stakeholders while also generating valuable insights into information demand.

Remaining challenges for investors and practical recommendations for preparers

While the CSRD marks a major step toward a more transparent and investor-relevant ESG landscape, several challenges remain. At the same time, these offer clear guidance for preparers:

Convergence (global and within CSRD) is still evolving

Investor challenge: Investors struggle to compare CSRD disclosures with ISSB- or GRI-based reports, and even CSRD adopters diverge in structure, terminology, and detail.

Recommendation: Where possible, reference alignment with global frameworks (e.g., GRI, TCFD, ISSB). To support convergence across CSRD reporters, tools like our Sustainability Reporting Navigator benchmarking dashboard allow firms to compare disclosures with selected peers, helping to identify gaps and alignment opportunities.Assurance and enforcement are still ramping up

Investor challenge: Without strong assurance, trust in ESG data remains limited.

Recommendation: Signal credibility by obtaining reasonable assurance for key datapoints and restating prior data when better methods are available. This builds trust and reduces perceived risk.Some investors still rely on alternative data or DIY approaches

Investor challenge: Gaps in disclosures, especially regarding financial relevance, lead some investors to rely on external estimates or models.

Recommendation: Increase transparency by explaining assumptions and methods (e.g., in the DMA), and strengthen connectivity by linking ESG topics to anticipated financial effects.Regulatory complexity and national divergence create uncertainty

Investor challenge: Uneven national transposition and ongoing adjustments (e.g., the “Omnibus” debate) blur comparability.

Recommendation: Stick to the ESRS structure and terminology, and clearly flag transitional provisions or national deviations.Accessibility and usability of ESG data remain a concern

Investor challenge: Even strong disclosures are hard to use if buried in unstructured reports.

Recommendation: Use clear headings, structured formats such as tables and comparatives, and tagged or cross-referenced information to improve navigation. Digital, web-based formats can further enhance usability and allow preparers to learn from user behavior —helping to close the gap between information supply and demand.

As CSRD implementation matures, preparers who focus on usability, connectivity, and comparability are best positioned to meet growing investor expectations and to turn regulatory compliance into an opportunity for strategic, capital-market-oriented communication.

Maximilian Müller

is Professor at the University of Cologne and co-founder of the Sustainability Reporting Navigator. He is affiliated with ESMT Berlin’s Institute for Sustainable Transformation and a Principal Investigator in the DFG-funded project Accounting for Transparency. He also serves on DHL’s Sustainability Advisory Council and in the Advisory Board of Sunhat, a start-up focusing on ESG request management.